The Island Boys' Financial Rollercoaster

The Island Boys, Kodiyakredd and Flyysoulja, achieved viral fame with their catchy TikTok hit, "I'm an Island Boy." This led to a surge in income from TikTok ads, Cameo appearances, YouTube revenue, and music sales. However, determining their exact net worth proves surprisingly challenging, with estimates varying wildly. This article explores the complexities of their financial journey, examining their income sources, the risks they face, and the lessons learned about online success and financial management.

Unraveling the Mystery of the Island Boys' Finances

Precisely calculating Kodiyakredd's and Flyysoulja's net worth remains elusive due to the inherent volatility of their social media-driven income. Reports range from a conservative $200,000 to a more optimistic $1–2 million, reflecting the fluctuating nature of earnings derived from viral trends. One day, reports suggest they earned $40,000, yet other days yielded significantly less. This highlights the unstable nature of online fame and the difficulty in assessing a consistent net worth. Isn't it striking how quickly fortunes can rise and fall in the digital realm?

The Double-Edged Sword of Viral Success: A Risky Business Model

The Island Boys’ financial situation underscores the risks of relying on a single viral hit. Their initial success, almost entirely dependent on one video, created a precarious foundation. This lack of diversification is a significant concern. Their revenue model, much like building a sandcastle on the beach, is vulnerable to the tides of changing algorithms, audience preferences, and online trends. How can influencers build more resilient financial models to sustain their success beyond the fleeting nature of viral fame?

Income Streams: A Detailed Analysis

The Island Boys diversified (somewhat) across platforms: TikTok ads provided substantial initial income, while Cameo appearances and YouTube ad revenue added to their earnings. Music sales also contributed, but the long-term sustainability of this multi-platform model remains questionable. Could a more strategic approach to diversification increase their financial stability?

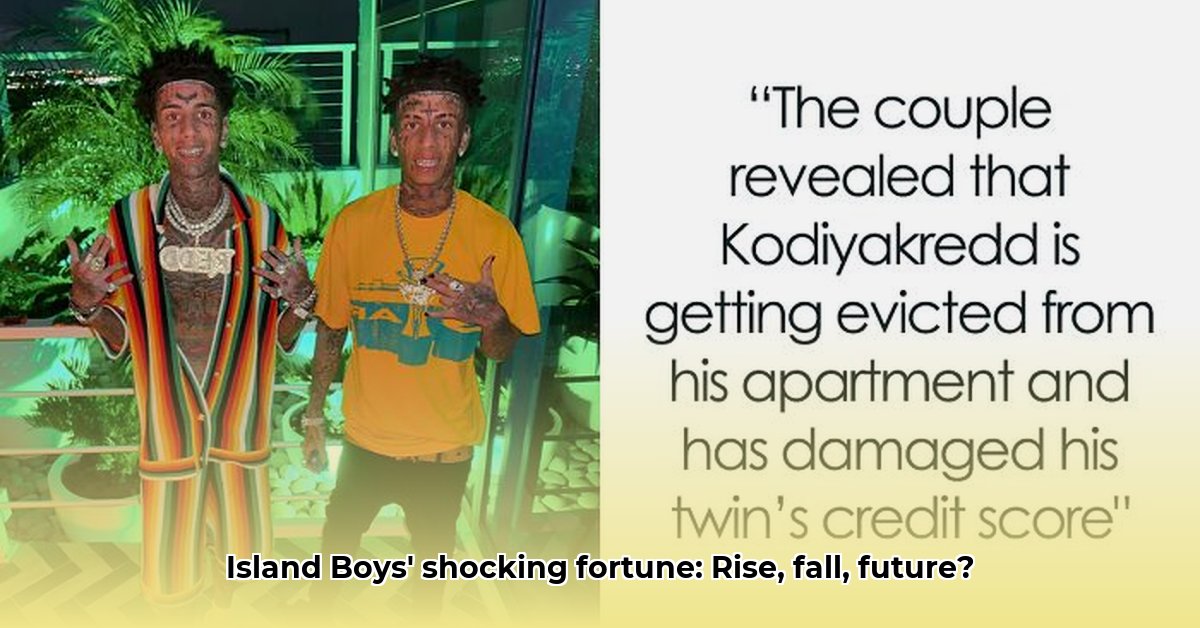

Navigating Challenges: Legal and Management Issues

Reports of legal issues—ranging from traffic violations to potential eviction—and disagreements with their management team complicate their financial picture. These challenges underscore the importance of professional guidance in legal and financial matters for social media influencers. How crucial is expert financial and legal advice for navigating the complexities of managing sudden wealth and maintaining long-term financial health?

Building a Sustainable Future: Strategies for Long-Term Financial Stability

Long-term financial success in the volatile world of social media requires more than viral moments. It demands comprehensive planning, diversified income streams, and proactive risk management. The Island Boys need to develop sustainable business models and minimize their reliance on fleeting trends. Seeking professional financial and legal guidance is also crucial for their future financial well-being.

Actionable Steps for Long-Term Financial Health:

- Diversification: Explore multiple revenue streams beyond social media, including merchandise, brand deals, and investments (reduces reliance on unpredictable social media trends; creates more stable income streams).

- Financial Literacy & Professional Guidance: Invest in professional financial advice and develop essential financial skills (makes informed decisions; safeguards against financial pitfalls; builds long-term wealth).

- Risk Management: Develop strategies to mitigate the impact of sudden shifts in online trends and algorithms (prevents devastating financial setbacks; promotes resilience during periods of downturn).

Conclusion: Lessons from the Island Boys' Journey

The Island Boys' experience serves as a cautionary tale of the volatile nature of internet fame. Their journey highlights the paramount importance of financial planning, diversified income streams, and professional guidance for navigating the unpredictable world of social media influence. Their long-term financial well-being critically hinges on adapting to these lessons and building a more sustainable path to success.